Have you ever wondered how the Pinellas Suncoast Transit Authority is funded? Let’s pull back the curtains and explore how this essential, government-funded organization acquires funding to serve the community and push the boundaries of public transit!

While every transit authority across the country has relatively the same goals, the way they got started and how they're funded through taxpayer money can vary wildly. Some transit authorities are funded largely through sales taxes, while others rely on property taxes. So, where does PSTA fall on the spectrum compared to other transit authorities around the country?

First, we need a tiny history lesson.

A Little History

St. Petersburg & Gulf Railway Company, created by Philadelphia businessman F. A. Davis. The very first streetcar line would run from St. Petersburg to Gulfport, known as Disston City back then. And most notably, first as a private company and then as a City of St. Petersburg municipal department, it actually made money until the mid-1960s.

St. Petersburg and Gulf Railway Company Streetcar, 1919

Thanks to the early 1920s boom, St. Petersburg voters would approve a bond issue, enabling the city to run the lines as the St. Petersburg Municipal Transit System (SPMTS). The SPMTS street car would continue its reign until May 7th, 1949, when it made its final journey to Gulfport before its retirement.

SPMTS would move to buses, ending the streetcar’s monopoly. The system’s first bus was a simple six-wheeled vehicle comprised of two Ford automobiles welded together. Throughout the decades, SPMTS and other transit companies in Clearwater along the Gulf Beaches and Tarpon Springs were all operated for a profit—it cost a meager 5 cents to ride. In fact, public transit in Pinellas County would remain for-profit until the mid-1960s when prioritization of the automobile led to the opening of US 19 as a federally funded highway in St. Petersburg in 1955, and the I-275 Howard Franklin Bridge was opened across the Tampa Bay in 1962.

St. Petersburg Municipal Transit System, circa early ‘80s

Federal funding for mass transportation projects began in 1962 and was expanded in 1970 with the adoption of the Urban Mass Transportation Act of 1970. That same year, Florida passed legislation to create the Central Pinellas Transit Authority (CPTA) to take over a failing private Clearwater Transit Company, Inc. and soon passed a referendum to make CPTA an independent transit authority with taxing capabilities. No more would Pinellas County public transit be for-profit—CPTA was a recognized government agency.

Following the energy crisis of the mid-1970s, when gasoline prices spiked to over $1.00 per gallon, ridership on the two Pinellas transit systems grew as well, sparking interest in unifying the two local bus systems into a countywide system. So, in 1982, CPTA and SPMTS would merge to create the Pinellas Suncoast Transit Authority (PSTA) we know and love today!

St. Petersburg Municipal Transit System, circa early ‘80s

Operations vs. Capital

When we talk about PSTA funding, we can’t overlook the distinction between operations funding and capital funding. The first one is probably pretty obvious—operations comprise the day-to-day costs of everything from keeping the lights on and paying employees to fueling/charging the buses and performing maintenance on them.

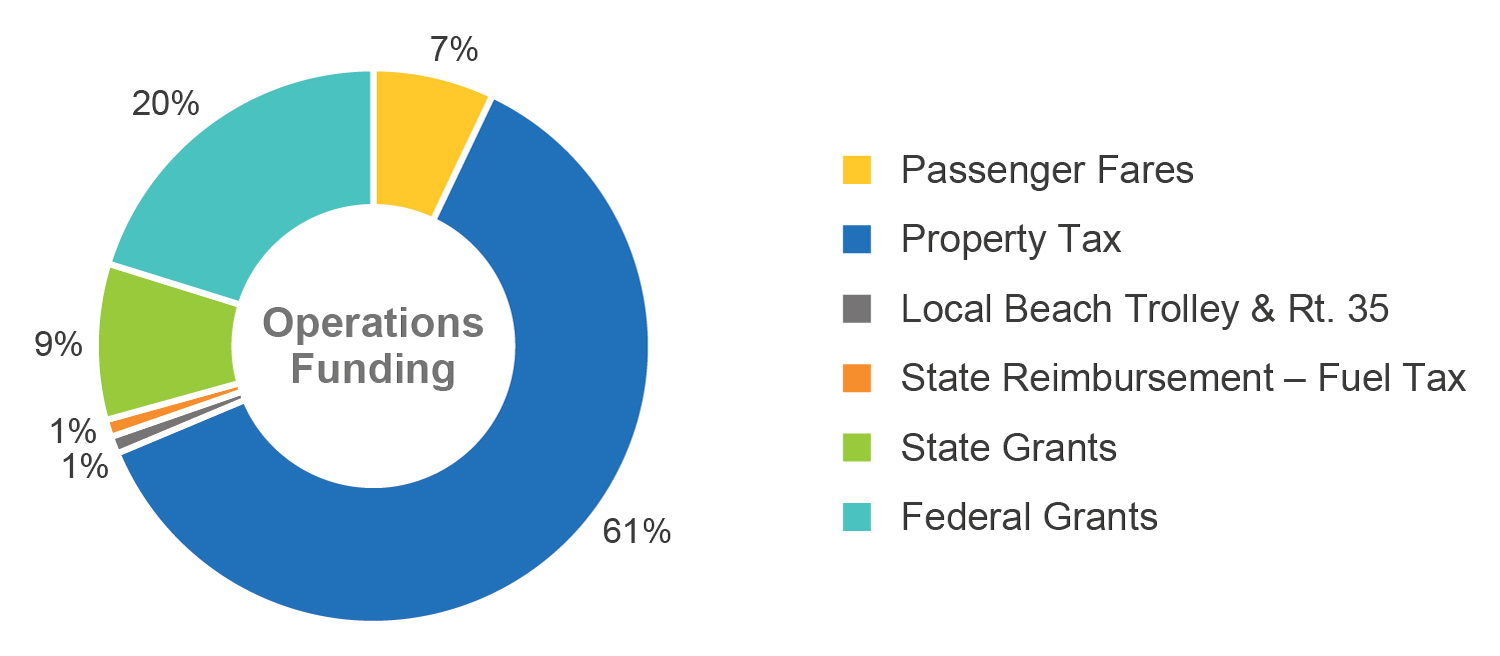

Operations Funding, 2023 Adopted Operating & Capital Budget

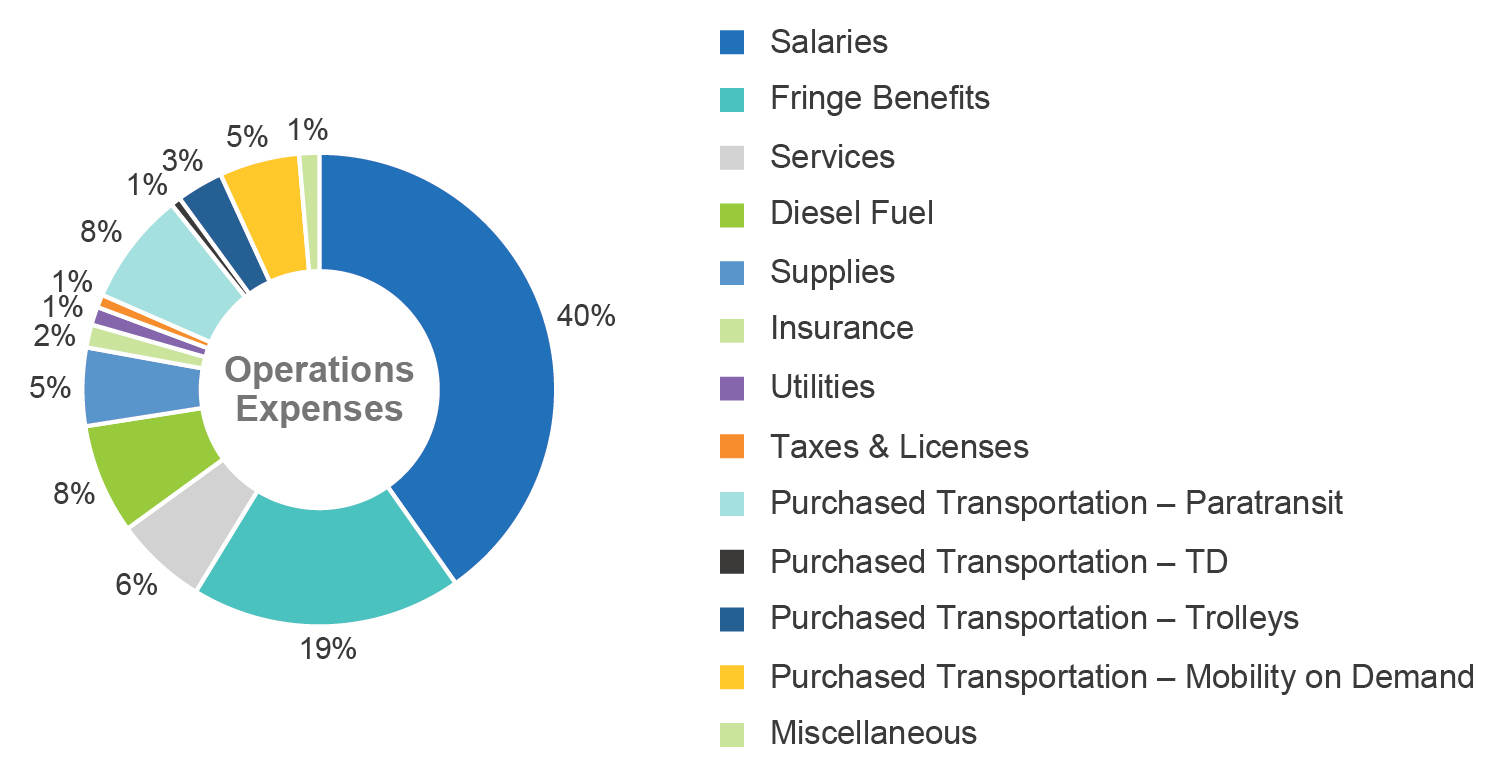

Operations Expenses, 2023 Adopted Operating & Capital Budget

While these costs aren’t as exciting as a ground-breaking or the launch of a new Bus Rapid Transit (ahem, SunRunner), operations are obviously essential. Fares and property taxes provide the bulk of these funds, so if you’re a homeowner, you’ve been helping PSTA continue its passion for providing essential transportation to Pinellas County and beyond.

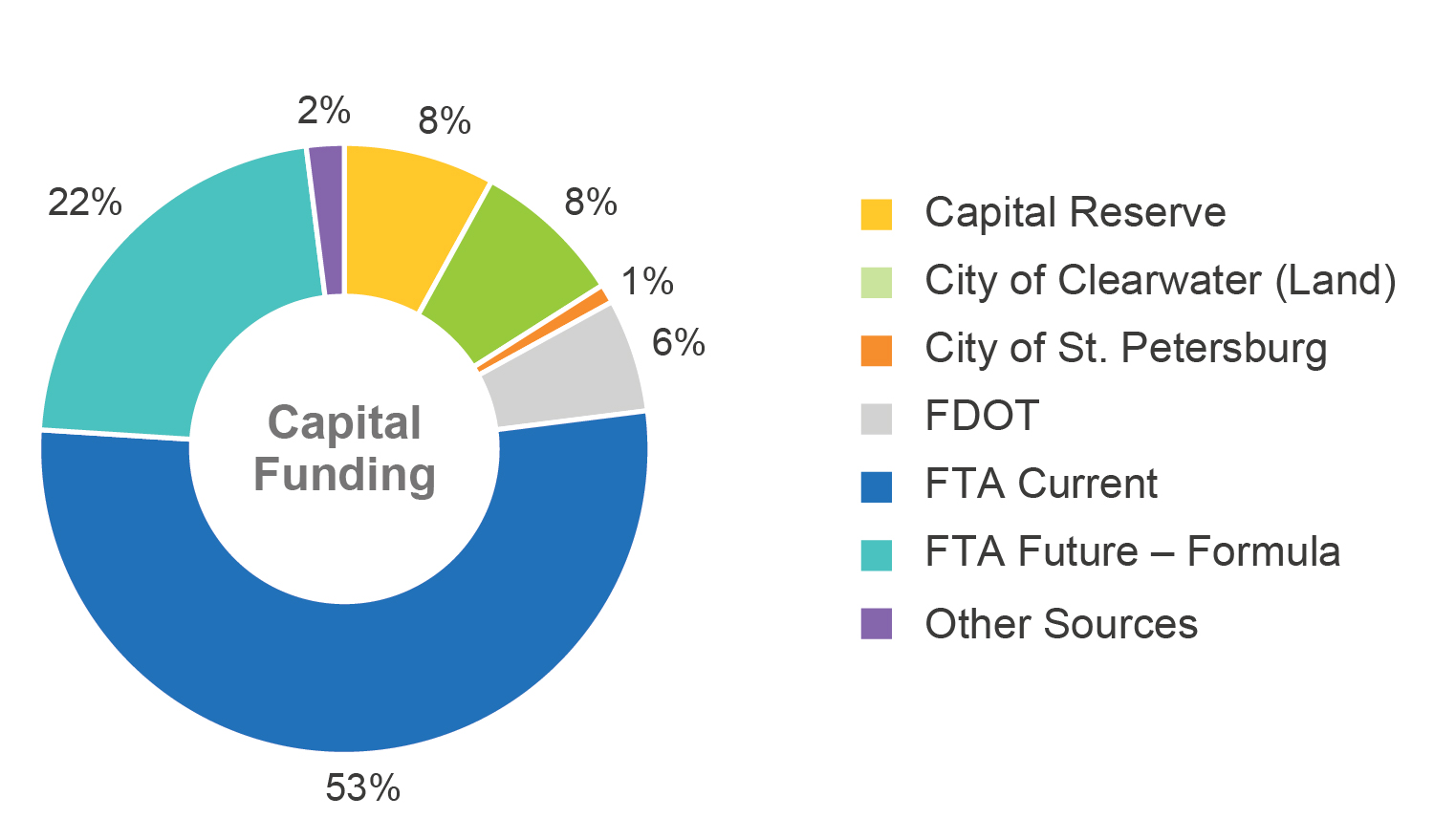

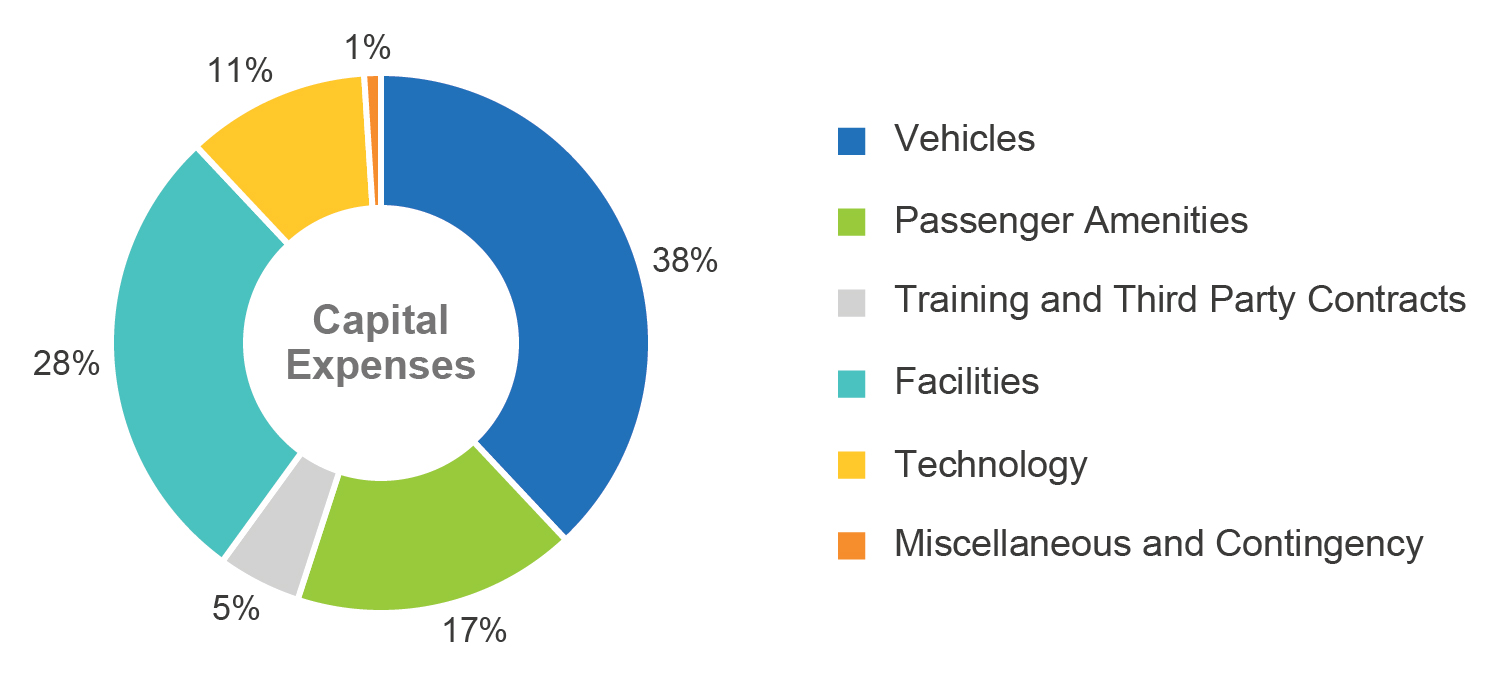

Capital, on the other hand, includes things like buying buses, buildings, shelters, and computers and launching exciting new offerings like the SunRunner or the new upcoming Clearwater Transit Center. These efforts are funded by the federal government through grant applications, the Federal Transit Administration, the Florida Department of Transportation, and the city of St. Petersburg.

Capital Funding, 2023 Adopted Operating & Capital Budget

Capital Expenses, 2023 Adopted Operating & Capital Budget

Aside from fares, taxes, grants, and settlements, PSTA also makes a very small percentage from advertising, usually in the form of advertisements on buses and shelters, paid for by local businesses. In short, operations are funded by fares and property taxes, and capital is funded by applying for federal grants. This breakdown between operating and capital expenses is very similar to transit systems in other cities like ours.

Grants, Taxes, and Settlements—Oh My!

Between grants and taxes, all of which are provided in some way by taxpayers, PSTA has to be very efficient and responsible about how funds are allocated. According to the National Transit Database, PSTA is one of the least funded transit authorities in the country, so a huge amount of effort is put into ensuring that, once the funding is secured, it goes a long way.

Despite lower funding, however, PSTA is incredibly efficient in how we manage the money we have. According to data from the American Bus Benchmarking Group, among the list of lowest-funded transit authorities in the country, PSTA has one of the lowest operating costs per vehicle per hour. In 2022, PSTA was the fourth largest transit system in Florida (behind Miami-Dade, Broward/Ft. Lauderdale, and Orlando, but we only have the seventh most operating expenses demonstrating PSTA’s ability to stretch those dollars.

Grants

Let’s start with grants. Government grants are funded from collection and taxes, usually requiring applications in order to vie for being awarded that highly-coveted funding. And these are no college applications—they require highly-detailed developmental studies, reports, and painstakingly compiled explanations for planning, organization, and financial data.

A great recent example of grant money going a long way is the SunRunner Bus Rapid Transit that launched in October of 2022. It was all made possible by the $21.8 million awarded through the Federal Transportation Agency’s Capital Investment Grant program—and this was the very first Capital Investment Grant ever awarded to the Tampa Bay region! In addition to the FTA grant, the Florida Department of Transportation (FDOT) provided 25% of the funding, while PSTA and the City of St. Petersburg split the remaining construction costs.

Taxes

So what about the aforementioned property taxes? PSTA is a bit unique in that our local taxpayer funding comes in the form of property taxes rather than sales taxes. Many well-known transit authorities around the country (New York, Chicago, Los Angeles, and Miami, to name a few) use sales taxes, but what are the advantages and disadvantages between the two? One thing to consider is how many tourists come to Pinellas County.

According to the St. Petersburg/Clearwater Area Convention & Visitors Bureau, St. Pete/Clearwater was the leading destination on the Gulf Coast in the U.S., drawing more than 6.5 million overnight visitors to the area in 2017. Although these are pre-COVID numbers, tourists have returned in droves since the pandemic, breaking records. That’s great for sales tax, but unless these visitors own property in the area, none of that money goes to the public transit they utilize throughout their visit.

Approximately 1/3rd of all Pinellas sales taxes are paid for by tourists. In 2014, voters of Pinellas County rejected a switch to a sales tax form of funding transit, despite the fact that sales taxes generate significantly more revenue than property taxes. If such a change was made, the majority of property-owning residents in Pinellas County would pay less for public transit, thanks to tourists picking up 1/3rd of the tab.

Changing our funding source to sales tax seems like the clear solution, then, right? Well, sales tax isn’t untouchable either. During the pandemic, fewer people were going to physical stores and spending money, so transit authorities who depend on sales tax suffered as a result. In fact, during COVID, the federal government contributed funding to the operations of transit authorities for the first time in history!

Settlements

Did you know that PSTA hasn’t had to spend a single cent of local property taxes on our electric buses? You may recall back in 2016, Volkswagen violated the Clean Air Act by selling approximately 590,000 vehicles equipped with defeat devices, which disable or interfere with strictly-enforced emissions controls. This resulted in a settlement requiring VW to provide $2.7 billion for the 2.0 liter violating vehicles and $225 million for the 3.0 liter violating vehicles to an Environmental Mitigation Trust.

Thanks to settlements like these, where huge companies are held accountable for their negligence and contribution to environmental damage, $18 million went to PSTA’s electric buses. The tragic 2010 Deepwater Horizon BP oil spill resulted in a $600,000 settlement for our first electric charger, the first inductive wireless electric bus charging station on the east coast!

While these environmental injustices are responsible for so much suffering, settlements like these serve as a silver lining—from moments of negligence and greed, PSTA and other transit authorities are able to institute incredible, green programs that drive us towards a future where the environment and humanity can co-exist pollution-free.

The Future of PSTA Funding

As you can see, the history of PSTA’s funding has been quite an adventure. From enterprising businessmen from the early 20th century to the careful balance of funds in the 21st century, public transit, in general, is always changing and growing. Looking to the future of funding for PSTA, there is a deep hunger and sense of duty to provide for the community by advocating with the state and federal government in both Tallahassee and Washington, DC.

Every year, PSTA’s board adopts legislative priorities and goals. CEO Brad Miller and other representatives then take their annual pilgrimage to the powers that be, presenting new ideas and dire needs to the Florida Department of Transportation, the Federal Department of Transportation, and anyone else with the power for change.

CEO Brad Miller at the Capitol

CEO Brad Miller speaking with Florida Senator Marco Rubio

The goal? Advocating to maintain funding and vying for even more to continue providing essential services to the community, as well as promoting our mission of diversity, equity, and inclusion. PSTA needs local investments from businesses and taxpayers to continue this important work!