Whereas last time was more of a bird’s eye view of PSTA’s funding sources and how those funds are used, part two is more topical and, perhaps, urgent. As the PSTA Board prepares to vote on its 2024 budget and what routes and other services can be funded, a certain topic has dominated the conversation: changing the millage rate, which determines how much funding PSTA will receive from property taxes.

If you’ve never heard of “millage rate” before, never fear! We’ll explain it all and more while also recapping the information we laid out in our last funding breakdown, “Deep Drive: How is PSTA Funded?”

Recap: How is PSTA Funded?

Time for a quick little review of everything PSTA funding!

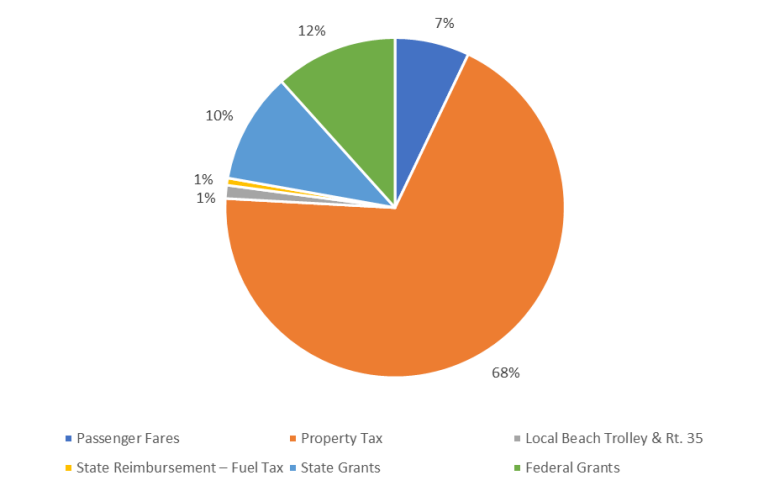

PSTA’s funding is separated into two sections: operating and capital. The operating budget comprises the day-to-day costs of everything from keeping the lights on and paying employees to fueling/charging the buses and performing maintenance on them. The vast majority of the funding for operating costs comes from property taxes. Florida’s Department of Transportation provides 10% of the operating revenues and—for one final year—PSTA will fund 12% of its operating expenses using one-time federal COVID relief funding. Interesting to note is that passenger fares only account for 7% of operating funding, while 90% comes from property tax and government grants! As you can see, the vast majority of PSTA’s funding comes from property tax, followed by federal and state grants.

Operations Funding, 2024 Adopted Operating & Capital Budget

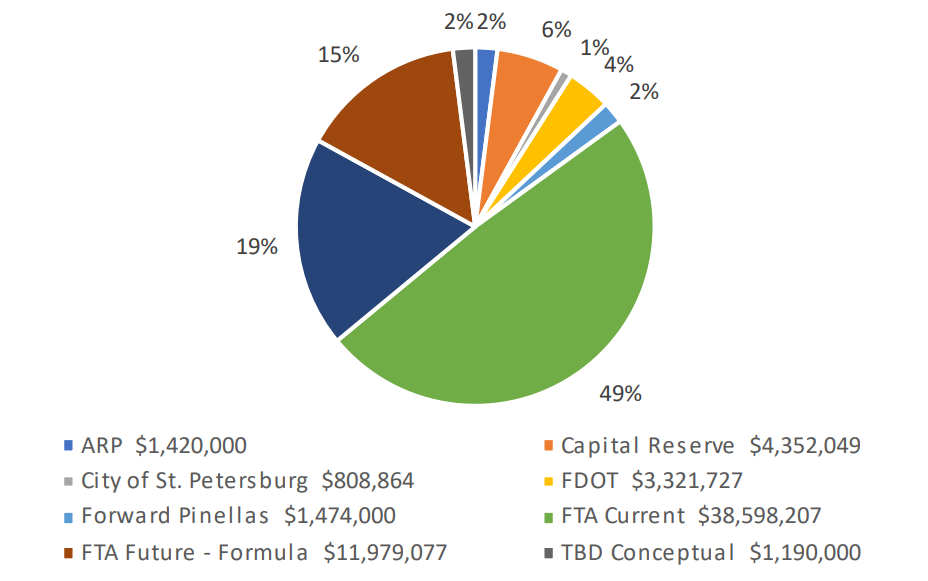

So, what about the capital budget and expenses, and how do they differ from the operating ones? Capital expenses cover tangible items such as buying buses, buildings, shelters, and computers, as well as paying for the initial cost for the SunRunner’s buses, stations, and red lanes or the new upcoming Clearwater Transit Center. These projects are almost exclusively funded by the federal government through various grants.

Capital Funding, 2024 Adopted Operating & Capital Budget

ARP: American Rescue Plan

FTA: Federal Transit Administration

FDOT: Florida Department of Transportation

TBD Conceptual: Funds we’ve identified that we need, but don’t have a source for yet.

The Truth About Millage and Property Taxes

Let’s be honest: taxes can be confusing. Before your eyes glaze over, let’s define some important terms to understand.

Property Taxes: a tax paid on property owned by an individual or other legal entity.

Millage: the tax rate on real estate used to calculate property tax. This rate is reported in units called “mills,” and one mill is one dollar per $1,000 of assessed value.

Assessed Value: this refers to the value of your property that has been determined by the Pinellas County Property Appraiser as taxable. This number is different, and often lower, than the market value or sale price of a property.

Rollback Rate: a tax rate that produces the same amount of tax dollars as the previous year. Calculation of the “rolled-back rate” is governed by Florida Statutes. The rollback rate is based on the total amount of taxable value of property (excluding new construction) in the county, so individual properties may see their tax payments go up or down.

TRIM: refers to the Truth in Millage (TRIM) Act, which was passed by the 1980 Florida Legislature to inform taxpayers which governmental entities are responsible for the taxes levied and the amount of tax liability taxpayers owe to each taxing authority.

In short, for most Pinellas County homeowners who pay property taxes, a portion of those property taxes go to PSTA (note that there are a few areas of the county don't contribute to PSTA). To be more specific, 0.75 mills of your property taxes go to PSTA. That’s right—PSTA receives 75 cents for every thousand dollars of assessed property value. No matter how much the property value may increase, your “taxable” property value can’t go up by more than 10% each year, and if the homeowner has a homestead exemption, the value of home can only go up a maximum of 3% each year. This tax isn’t only assessed on homeowners, but all property owners in the county, including business and commercial properties.

This 0.75 mills is PSTA’s current millage rate and also happens to be the maximum our millage rate can be, meaning it can never be increased any higher without approval from the state legislature. However, the rate can be lowered by the PSTA Board of Directors. Lowering the millage rate is what is called a “rollback” and results in less funding for PSTA. We’ll go into what less funding for PSTA would look like in just a moment. First, let’s talk about that 0.75. Unless you’re a financial analyst or tax expert, that number lacks real-world context.

If you want to see exactly how much you personally will pay towards PSTA (if any), we highly recommend you check out the Pinellas County Property Appraiser’s Tax Estimator and see the amount for yourself. Here’s an example of the property tax breakdown for a house in Clearwater at the median property value for Pinellas ($455,000) to put in context how little goes to PSTA compared to larger items.

Estimated Ad Valorem Taxes, Mike Twitty, MAI, CFA, Pinellas County Property Appraiser

As you can see above, PSTA (listed under “Suncoast Transit Authority”) is receiving a fraction of your property taxes. In this case, it’s less than four cents out of every dollar you pay. One more note: around 5% of the property taxes meant for PSTA aren’t received during a given year because people pay their taxes late or not at all.

Millage Rate Rollback and Consequences

Currently, there is discussion around rolling back this millage rate from 0.75 to 0.6764, referred to as a “full rollback.” “Partial rollbacks” are also being discussed. While the difference between 0.75 and 0.6764 may seem small, every decimal place can have a dramatic effect on the budget for transportation in Pinellas County. For every 0.0007 mills that we bring the millage rate down (which works out to 27 cents in taxes a year for a typical property in Pinellas), PSTA has to reduce its spending on transit services by $100,000.

This year’s budget has been especially tricky for two big reasons: inflation and the ending of federal COVID relief funds. Even without a millage rate rollback, PSTA’s budget is already being squeezed to require route reductions in order to have a balanced budget. In fact, PSTA has already reduced its budget by $5.5 million in administrative and other expenses without cutting any of our bus services for 2024. But an additional $1.5 million made up of route reductions is necessary to keep a balanced budget so PSTA can continue to be good stewards financially.

The routes currently under consideration for removal due to lower ridership include:

- Route 813: Dunedin – Countryside Mall to Dunedin to Alderman Rd. (700 monthly rides)

- Route 814: Safety Harbor – Countryside Mall to Downtown Safety Harbor (900 monthly rides)

- Route 90: St. Pete/St. Pete Beach – Commuter Service between South St. Pete & St. Pete Beach (1,600 monthly rides)

- Route 32: Downtown St. Petersburg – Circular route serving John Knox Housing (1,700 monthly rides)

- Route 5: St. Petersburg – 5th Ave. N from Grand Central to Tyrone Square Mall (2,900 monthly rides)

- Route 58: Bryan Dairy/Seminole — Serving Carillon to 113th St. to SPC Seminole Campus (2,700 monthly rides)

In addition, these service reductions are also under consideration:

- Reduce trips on limited stop 52LX (2,000 monthly rides)

- Central Avenue Trolley would operate between St. Pete Pier and Grand Central Station only (800 monthly rides)

- PSTA Access Mobility on Demand incremental fare increases (5,000 annual ride reduction)

- Reduce route 59 Ulmerton Road from PSTA to Beach from 15-minute frequency to 20-minute frequency (3,000 monthly rides)

- End all routes at 10 p.m. ( Which would affect 4, 9, 14, 18, 19, 34, 52, 59, 60, 78 (Sat. only), CAT, SCBT, All Jolley Trolley Routes) (9,000 monthly rides)

- Eliminate ⅓ one-third of trash collection costs (remove PSTA trash cans or replace with city-serviced trash pick-up)

Keep in mind, these cuts are being considered in order to stay on budget, not due to a rollback. Introducing a full or partial rollback would result in as many as 23 additional routes being cut.

Why Do Some Want to Rollback the Millage Rate?

Some believe that staying at the maximum millage rate is not fiscally responsible and a lower millage rate would give PSTA room to increase it some time in the future in the case of emergencies. Some have suggested PSTA spend the limited money it has saved up in its reserves to aid with the lower funding. However, once those reserves are used, they are gone, and there simply isn’t enough money in reserves to make up for what would be lost by a full rollback.

The other big reason some want a rollback is to save homeowners money. So, how much would a full rollback save taxpayers?

A full rollback would save the average Pinellas homeowner around $14.48 a year.

Yes, a taxpayer could buy a few tacos with this money—who doesn’t love tacos? However, what about the cook making those tacos, who relies on PSTA to get to work every day? Without an affordable ride with PSTA, that incredible cook loses out on that job. And you lose out on those tasty tacos. While some homeowners in Pinellas County may save a small amount of money, the extreme and inevitable cuts in bus service may make it impossible for a large number of Pinellas County residents to get to work, doctor’s appointments, and all the places PSTA takes them.

However, homeowners are not carrying the sole burden of contributing to PSTA through property taxes. Here are the top three individual contributors to Pinellas property taxes that go to PSTA:

- Publix Super Markets

- Wal-Mart Stores

- Bellwether Properties, LLC

Some supporters of a rollback point out the SunRunner’s current fare-free status as a potential source of revenue should a rollback occur. Unfortunately, even if the SunRunner did start charging fares, such revenue would not be enough to account for the loss in funding due to a rollback.

What Would a Full Rollback Look Like?

Keep in mind that PSTA has already worked extensively to lower the budget prior to rollback discussions. With a full rollback to 0.6764, the effects on PSTA’s service and employees are dramatic. A full rollback would require a further $7.6 million to be cut from the budget. Those cuts would force PSTA to:

- Cut as many as 23 of the lowest ridership routes, including Jolley Trolley Coastal and Looper, affecting more than 1.9 million riders

- Lay off 100 employees

- No pay increases for non-union employees (580 union members get a 3% increase by contract)

- PSTA Access service area reduced

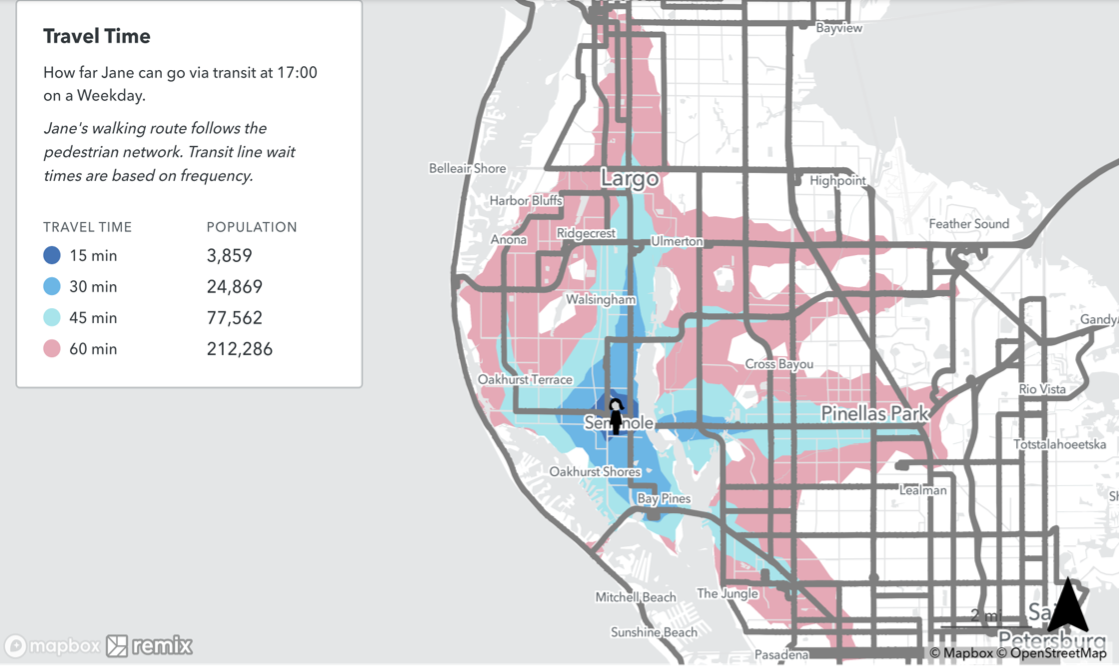

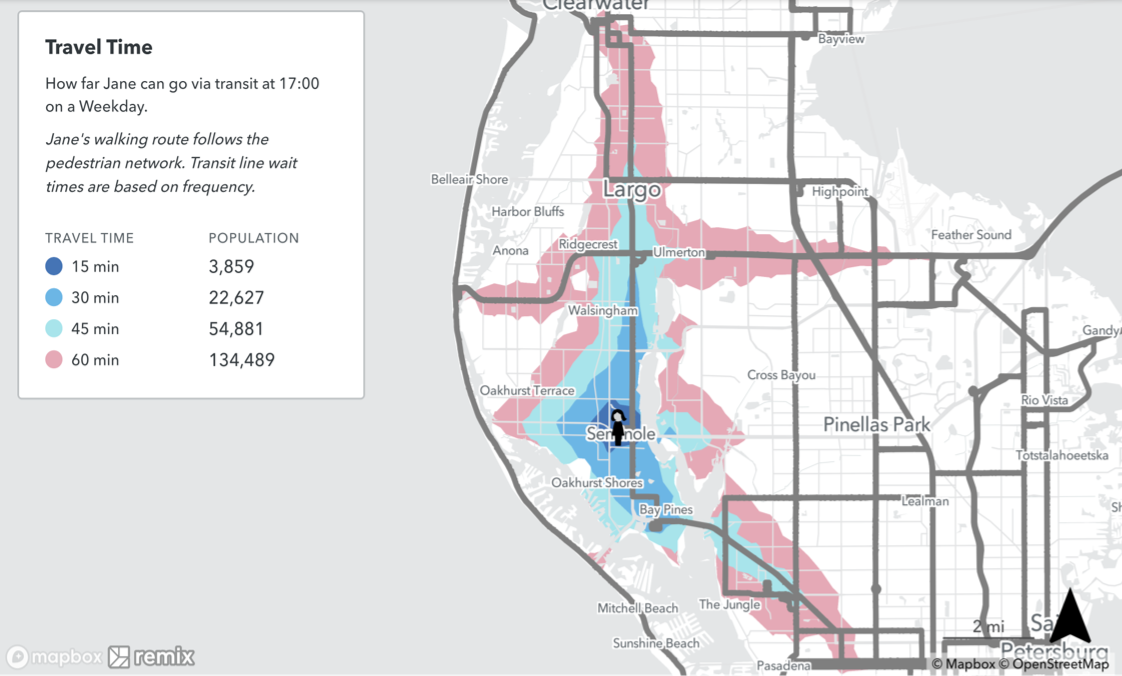

Here’s a visual representation of how long it takes riders to travel with the current millage rate and services versus the grim outlook after a full rollback. For our hypothetical rider, “Jane,” the areas in pink indicate areas she can travel to within an hour. Note the extreme reduction in areas Jane can reach within an hour after service cuts due to the rollback.

Travel times with current service and millage rate

Travel times after full rollback and service cuts

For the people who depend on PSTA to get to work, school, medical care, and connections with family and friends, the cuts in service will have serious consequences. The cuts are estimated to affect 1.9 million rides in one year.

What Would a Partial Rollback Look Like?

Clearly, a full rollback would be devastating for many Pinellas County residents. But what about compromising with a partial rollback? If all recommended major cuts are made to balance the budget, a partial rollback at around 0.7217 is technically possible.

However, any reduction in millage rate will still result in severe service cuts, service area reductions, and the possibility of some employee layoffs. The bottom line is that any reduction in our millage rate will endanger the health of PSTA’s budget and reserves, as well as make transportation much harder to access for the people who rely on it the most.

Could We Improve How PSTA is Currently Funded?

As we’ve mentioned before, PSTA is unique in its property tax funding source. Many other transit agencies instead get their funding from sales tax. But which one is better? Well, it’s a little more complicated than that.

Considering the huge amount of tourism Pinellas County gets every year, funding from sales taxes would mean that tourists would also be contributing to our funding rather than just property owners. And tourists are likely to be using PSTA services, especially the beach trolleys and the new SunRunner linking downtown St. Pete and the beaches. Of course, there is a downside to sales taxes—funding becomes dependent on people’s shopping behaviors, rather than the relatively stable source of property taxes.

For example, during the pandemic, when fewer people were going shopping, some agencies funded by sales taxes saw a decrease in funding. The housing market does experience volatility, of course, but is generally easier to monitor and forecast than shopping behavior.

Even still, changing PSTA’s funding to sales taxes could still be a viable option for future consideration. In fact, such a change was attempted back in 2014 with the introduction of Greenlight Pinellas. The Greenlight Pinellas transit referendum would have replaced the property tax millage with a penny from Pinellas County’s sales tax, providing PSTA with greater funding that would allow us to expand the county's bus service and build a 24-mile light rail system connecting St. Petersburg and Clearwater.

To the disappointment of many of its supporters, the referendum did not pass. Perhaps future referendums can benefit from the lessons learned with Greenlight Pinellas and we may see a day where PSTA is funded by sales tax instead of property taxes.

What Can You Do to Help PSTA?

PSTA is already one of the lowest-funded public transit agencies in the nation per capita. Because we are the most densely populated county in the state of Florida, with more and more people moving to our beautiful communities, we have next to zero room to build new roads.

With requests from the community for better service, higher frequency, and faster commutes, it’s clear that PSTA is and will continue to be essential to how Pinellas County residents and visitors get around.

While this all may sound very doom and gloom, the good news is that there is something you can do to help. One of the easiest ways is to become a PSTA rider if you aren’t already. See for yourself how you can save money, help the environment, and enjoy the ride!

The other way you can help is by attending the upcoming public hearings about the topic of service cuts and the millage rollback. There are two public hearings scheduled—September 13th at 6 p.m., and September 27th at 6 p.m. If you want to maintain as much service as is practical, come to the public hearings and voice your commitment to public transit!

If you’re unable to attend the public hearings, you can always email PublicComments@psta.net to share your thoughts or call our InfoLine at 727-540-1900.

If you’d like to hear what PSTA’s Board of Directors has to say on the topic of the rollback rate, check out the most recent board meeting here.